-

(818) 833-8737

13521 Hubbard St.Sylmar, CA 91342

- Login

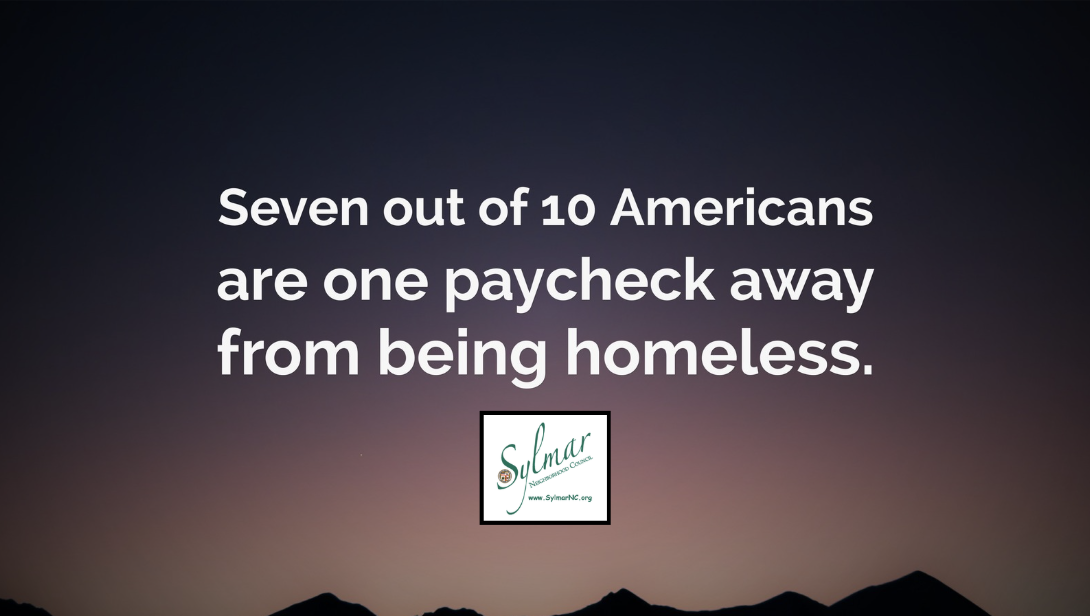

Living Paycheck to Paycheck • Homelessness

Posted on 11/16/2025

For homelessness assistance in Los Angeles, you should contact the Los Angeles Homeless Service Authority (LAHSA) and use the Los Angeles Homeless Outreach Portal.

• To learn more or to make a request for assistance•

Outreach Portal - https://www.lahsa.org/portal/apps/la-hop/

Contact Form - https://www.lahsa.org/support/contact-us?t=7-la-hop&ref=lahop

LAHSA - https://www.lahsa.org/

Human interest story

CBS News - 60 Minutes -

https://www.cbs.com/shows/video/Umaq8c34h24dSgGoqwPIZIft1grcmybq/

More Information

Being “paycheck to paycheck” means many Americans are one crisis away from homelessness due to factors like low wages, high housing costs, and inadequate safety nets. A significant percentage of the population, sometimes reported as over half, lives with little or no savings, making them highly vulnerable to job loss, medical emergencies, or other unexpected expenses that could lead to losing their housing.

Contributing factors

- Stagnant wages vs. rising costs: Wages have not kept pace with the rising cost of housing, food, and other necessities, making it difficult to save money for unexpected events.

- High cost of housing: Even for those working full-time, the cost of a basic apartment is often unaffordable, with the average annual earnings for people experiencing homelessness being far below what is needed for rent.

- Lack of savings and safety nets: Many Americans, especially low-income households, have little to no savings. Additionally, inadequate social safety nets and underfunded programs fail to protect people from falling into homelessness when faced with job loss or other crises.

- Precarious work: Jobs with unstable income, such as gig work, lack of benefits like health insurance and paid time off, and underemployment, can put people at a high risk of losing their housing.

- Other crises: A single event like a job loss, a medical emergency, or a car problem can trigger a domino effect that leads to eviction and homelessness for those living paycheck to paycheck.

What "paycheck to paycheck" means

- Living paycheck to paycheck means a household spends most or all of its income on basic necessities, leaving little to no money for savings or emergencies.

- This can be especially true for low-income households, where nearly 30% were living paycheck to paycheck in one report.

- A 2025 Bank of America analysis found that about a quarter of U.S. households were spending over 95% of their income on necessities like housing, groceries, and utilities.

2025 Sylmar Community Holiday Party

Sign-Up • Receive Agendas

Upcoming Meetings & Events

- Dec10 Planning and Land Use Committee Meeting

- Dec11 SAVE THE DATE • SNC's Annual Holiday Party • Thursday, December 11th

- Dec12 Local Sylmar Church hosting Holiday event and dinner

- Dec17 Equestrian Committee Meeting

- Dec17 Free Produce/Food Distribution at Olive View/UCLA Medical Center 9:30am - 11:30am

Sylmar Community Calendar

MyLA311

My LA 311

Area Boundaries and Map

View our neighborhood council boundaries for which we deal with.

EMPOWER LA

NEIGHBORHOOD COUNCIL CALENDAR & EVENTS

The public is invited to attend all meetings.

NEIGHBORHOOD COUNCIL FUNDING SYSTEM DASHBOARD

SUBSCRIBE TO NC MEETING NOTIFICATION