-

(818) 833-8737

13521 Hubbard St.Sylmar, CA 91342

- Login

Sales Tax Hike To Be Decided By LA County Voters

Posted on 02/10/2026

By Jose Herrera, City News Service

LOS ANGELES, CA — Los Angeles County voters will decide in June whether to approve a temporary half-cent sales tax in an effort to support healthcare services amid reductions in state and federal funding, under a measure approved by the Board of Supervisors Tuesday.

The proposal, introduced by Supervisors Holly Mitchell and Hilda Solis in January, is called the Essential Services Restoration Act and asks voters to enact the half-cent general sales tax increase for five years, through Oct. 1, 2031.

An estimated $1 billion would be generated from the measure, according to the county.

The county sales tax currently stands at 9.75%. The latest proposed hike would increase it to 10.25%.

After hours of debate and public discussion Tuesday, the Board of Supervisors agreed on a 4-1 vote, with Supervisor Kathryn Barger dissenting, to place the proposal on the June ballot.

"Backfilling federal funding cuts on the backs of county taxpayers is not acceptable," Barger said in a statement after the vote. "Los Angeles County residents are already stretched thin. Last year, Bloomberg News reported that Los Angeles now has the highest sales tax rates of any major metropolitan region in the nation. This proposed half-cent increase would push us even higher, making our county less affordable for families and less appealing for consumers to shop and businesses to operate. We are risking imposing higher everyday costs and small businesses and employers choosing to leave Los Angeles County altogether."

Mitchell argued during the meeting, however, that healthcare services in the county will face dire losses if the board takes no action to restore funding that she said was slashed under the federal budget bill passed earlier this year.

Mitchell said the bill included "the largest federal funding cut to Medicaid in our nation's history."

"HR 1 pulled the rug out from under all of us," she said. "... That's how we got here."

The county sales tax already increased in April 2025 after voters approved Measure A, a half-cent sales hike that replaced Measure H, a quarter- cent sales tax. The funding from the tax supports homeless prevention initiatives.

Mitchell, who represents the Second District, encompassing south L.A. County cities and unincorporated areas, worked with a coalition of healthcare organizations and workers, called Restore Healthcare for Angelenos, on the proposal.

Coalition members have said that if the supervisors had not approved the proposal, they would have launched a signature-gathering campaign to place the measure on the November ballot anyway.

"The ballot measure that we are proposing is an urgent and necessary step to stop the damage, to protect access to life-saving care," Louise McCarthy, president and CEO of the Community Clinic Association of Los Angeles County, one of the organizations in the coalition, told LAist. "The stakes right now could not be higher."

In their motion, Mitchell and Solis said the tax measure would address the immediate need to provide financial support to the county's health care system amid reductions in state and federal funding.

"Unfortunately, after exhausting every existing alternative, this temporary emergency measure is the only option that can be implemented quickly enough to prevent hospital closures and the loss of health care access for at least hundreds of thousands of residents," the motion reads.

Last year's federal budget bill, known as the "One Big Beautiful Bill Act," which was approved and signed by Congress and President Donald Trump, detailed billions of dollars of reductions in healthcare funding. Those reductions to Medi-Cal, coupled with eligibility changes, will impact county residents, who could face loss of coverage and reduced access to care.

"The county's most impacted departments face projected losses totaling $2.4 billion over the next three years," the supervisors' motion reads. "Due to funding losses, county officials have already initiated hiring freezes and are contemplating service consolidations, potential layoffs of 5,000 staff, and facility closures in the coming years."

State funding reductions in healthcare are exacerbating the issue. Due to budget constraints, California rolled back health care coverage for undocumented immigrants and reduced funding for other initiatives.

In January, the California Department of Health Care Services stopped enrolling new adult patients without legal status in its state-funded health care program, Medi-Cal. The state is expected to cut non-emergency dental care for immigrants here illegally who are already enrolled in the program.

State officials agreed to enact a $30 monthly premium starting in July 2027 for immigrants who remain on the program, including those with legal status.

Federal dollars do not support these initiatives, as using federal funding for those here illegally is against the law.

A similar sales tax hike was approved in November by voters in Santa Clara County to address reductions in federal funding on health care, and some labor unions are pushing for a proposed statewide billionaires tax to support the health care system.

During Tuesday's debate on the Los Angeles County measure, supervisors on a divided vote agreed to amend the proposed allocation of dollars generated by the proposed tax. Under the final version, money raised by the measure would be spent as follows:

- up to 45% would support the county Department of Health Services;

- 5% would be allocated based on patient visits to nonprofit health agencies serving low-income and underserved populations;

- about 4% would benefit school-based health needs and programs as determined by the governing board of L.A. Care Health Plan;

- another 10% would support the county Department of Public Health and its core public health functions;

- about 3% would be allocated to the county Department of Public Social Services to support Medicaid outreach and enrollment activities, and volunteer programs;

- another 2.5% would go toward the Correctional Health Services;

- some 22% would fund DHS to safeguard public hospitals and clinic services;

- about 5% would be allocated to support nonprofit hospitals in the county, and provided funding to entities that meet certain criteria;

- another 2.5% would support in-home supportive services for seniors and people with disabilities;

- about 1% would support the cities of Pasadena and Long Beach, which have separate Public Health Departments from the county; and

- any remaining funds would be disbursed in a need-based manner focused on emergency department volume.

The proposed measure would also establish a nine-member citizens' oversight committee to ensure fiscal accountability for any revenue raised, which involves annual independent audits and making recommendations on how to allocate the funding.

Committee members would serve three-year terms and they would be eligible for reappointment by the Board of Supervisors.

The Howard Jarvis Taxpayers Association has criticized the proposed sales-tax measure.

"The sales tax is already too high in Los Angeles County, so high that the most recent half-percent increase for homelessness services required special legislation from the state to allow it to exceed the cap on local sales taxes that is in state law. Raising the sales tax again is unreasonable and unfairly harsh on those who are least able to afford it," the association said in a statement.

The organization is working to qualify an initiative constitutional amendment to rescind recently approved special taxes and ensure a two-third vote requirement for all local special taxes.

By Jose Herrera, City News Service

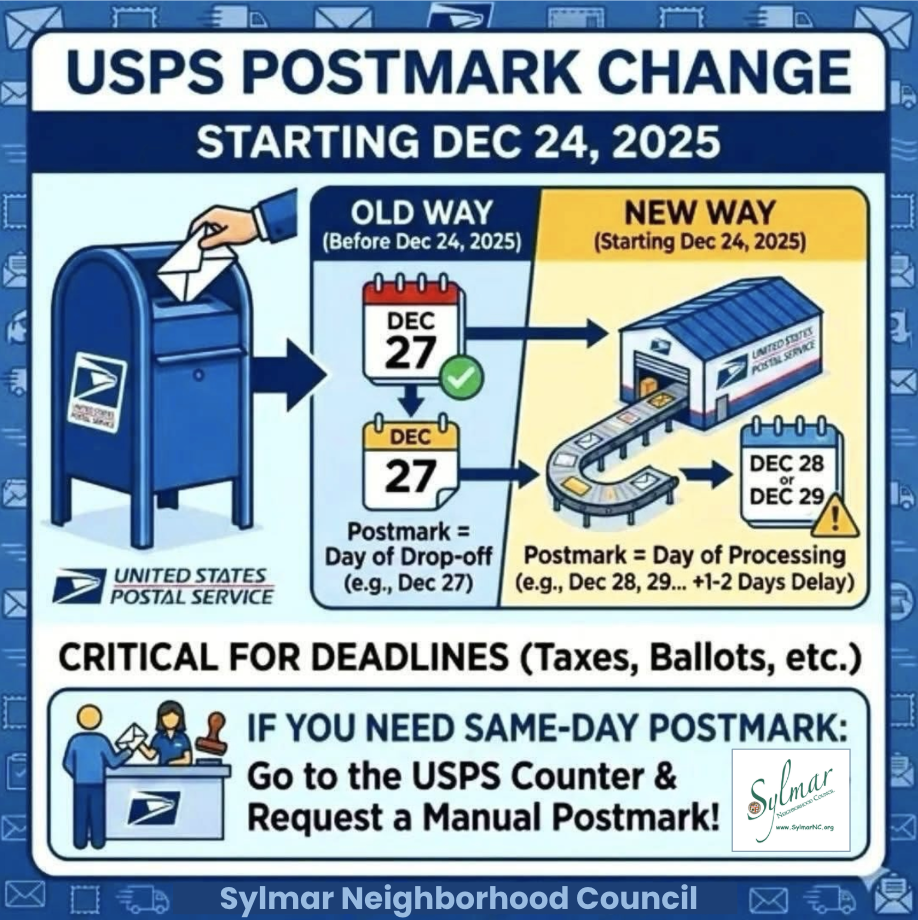

US Post Office Information

Small Business Saturday • May 9th

Sign-Up • Receive Agendas

Upcoming Meetings & Events

Sylmar Community Calendar

MyLA311

My LA 311

Area Boundaries and Map

View our neighborhood council boundaries for which we deal with.

EMPOWER LA

NEIGHBORHOOD COUNCIL CALENDAR & EVENTS

The public is invited to attend all meetings.

NEIGHBORHOOD COUNCIL FUNDING SYSTEM DASHBOARD

SUBSCRIBE TO NC MEETING NOTIFICATION